Published at Oct 06, 2023 by learn

Using Monte Carlo Simulation for Algorithmic Trading

Too Long; Didn't Read

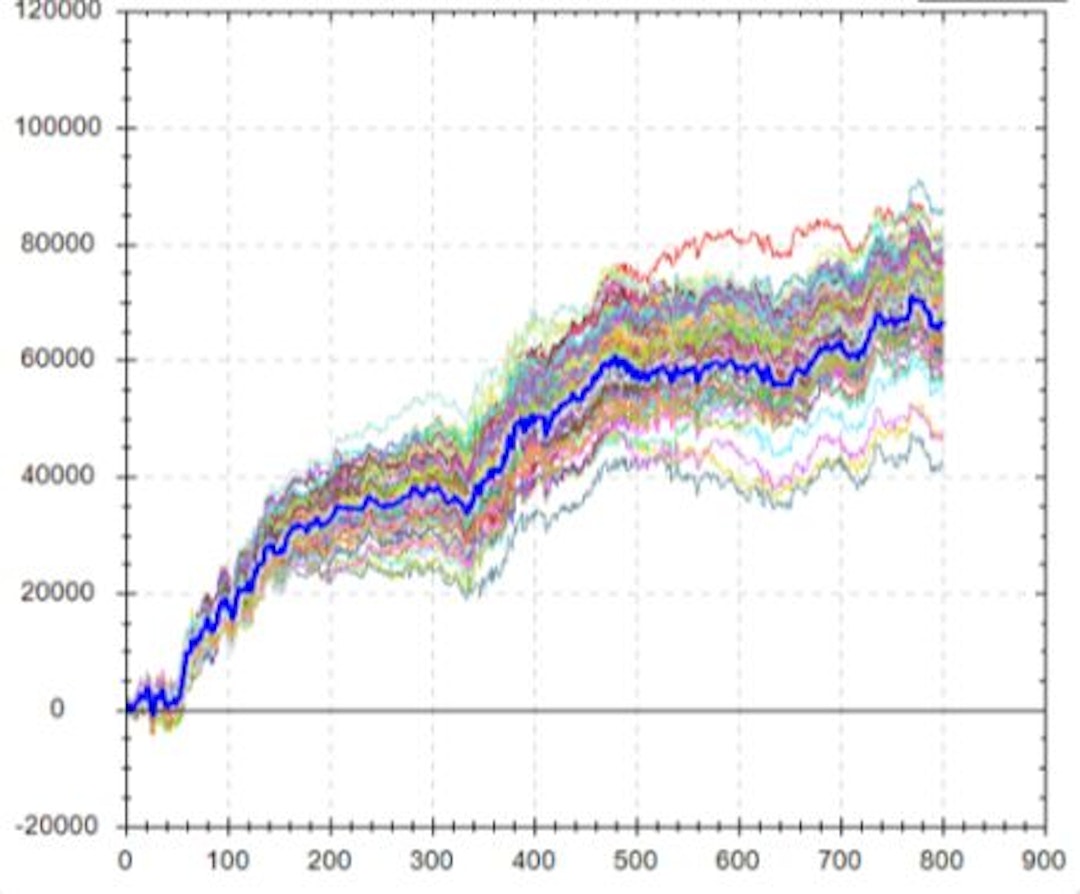

Monte Carlo Simulation is a statistical technique that injects randomness into a dataset to create probability distributions for better risk analysis and quantitative decision-making. Algo traders use Monte Carlo simulations to determine how much luck was involved in a strategy’s backtest and if future performance is likely to look like past performance. Monte Carlo Simulations help better simulate the unknown and are typically applied to problems that have uncertainty such as: trading, insurance, options pricing, games of chance, etc. The goal is to gain a better understanding of all the possible outcomes and potential minimum and maximum values a trading strategy can experience.@buildalpha

dburghQuantitative Trader and Developer. Founder of Build Alpha algo trading software

Receive Stories from @buildalpha

RELATED STORIES

L O A D I N G

. . . comments & more!

. . . comments & more!